8 Simple Techniques For Redbud Advisors, Llc

Table of ContentsFascination About Redbud Advisors, LlcHow Redbud Advisors, Llc can Save You Time, Stress, and Money.The smart Trick of Redbud Advisors, Llc That Nobody is DiscussingExamine This Report about Redbud Advisors, Llc4 Simple Techniques For Redbud Advisors, LlcFascination About Redbud Advisors, LlcHow Redbud Advisors, Llc can Save You Time, Stress, and Money.

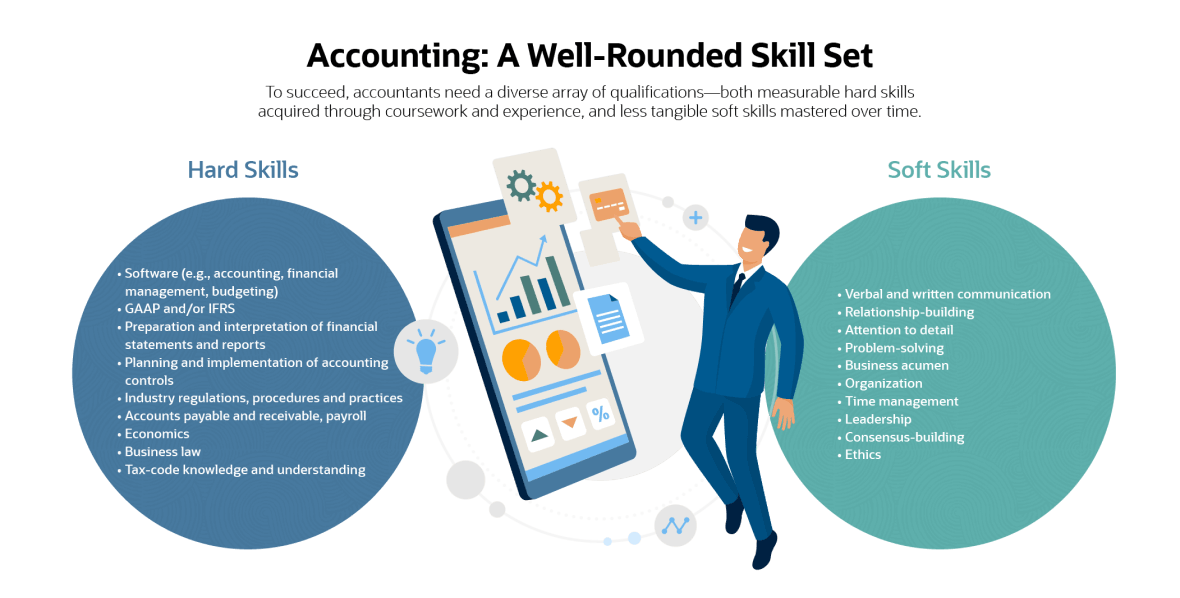

In the future, previous Mauldin & Jenkins companion Barie anticipates, modern technology will manage most of the tasks that team auditors do now. Each interaction group may have a committed IT individual, and maybe a staff auditor would examine the exemptions and abnormalities that the modern technology discovers as it audits all deals instead of simply the examples that engagement teams have the ability to audit currently.(These services would certainly not be carried out for audit clients, as a result of independence concerns.) As an example, a team accountant may manage many of the computational job, guaranteeing the modern technology and data assimilations are functioning, and getting in or remedying any type of data that were not input properly into the bookkeeping application from various other cloud-based systems.

See This Report about Redbud Advisors, Llc

(For a lot more on the modern technology alters that participants of the profession need to understand around, see "Paving the Method to a New Digital World.") Training is simply among myriad factors firms need to think about as they prepare for the future. Some in the profession, for instance, visualize the staffing structure of companies evolving from the present pyramid form to one with a slim top, a fat middle, and a narrow base.

"It's a matter of survival," he said. As for companies, Anderson advised them to enforce inner demands to not only discover new skills however likewise to start applying them right into their practice.

The Main Principles Of Redbud Advisors, Llc

Forensic accountants utilize a mix of audit and investigation skills to examine the precision of economic details, along with to help uncover monetary criminal activities such as fraud, embezzlement and money-laundering - Oklahoma Medical Marijuana Laws. They also assist in risk management and risk reduction, and may be asked to offer advice in regard to transactions such as mergers and acquisitions

Internal auditors review and report on the performance and performance of the tasks, processes and procedures within an organisation. They are included in compliance, risk management and corporate governance. Internal auditors generally report to the highest possible degree of monitoring, and will certainly provide recommendations for improvements to the frameworks and procedures within an organisation.

Assist in the solution of service technique. The duty of management accounting professional is a senior advising one, and management accounting professionals are as a result expected to perform themselves with professionalism and trust and honesty at all times.

The Ultimate Guide To Redbud Advisors, Llc

The 4 companies used to be eight, however because of mergings, acquisitions and dissolutions dating back to 1987, only four big companies continued to be by 2002. With each other, they amass more than $100 billion in incomes and have continually experienced growth year-over-year. There is no doubt why numerous grads and entry-level professionals pursue accounting professions at these firms.

By having a Master of Book-keeping (MAcc) degree, graduates can get a scholastic step up and a means of access. Right here are four qualities the Big 4 companies are looking for in brand-new hires. https://redbudadvisorsllc.godaddysites.com/f/redbud-advisors-llc-your-go-to-cannabis-accounting-firm-in-okc. To be recognized by the countless candidates that get positions at the Big 4, grads must stand apart.

After certifying, brand-new accounting professionals have the alternative of either operating in technique in an accountancy company or taking a sector function out in the organization globe. Both have their benefits and drawbacks, it just depends on the kind of person you are, your interests, and what is essential to you in your career.

Excitement About Redbud Advisors, Llc

Lots of accountants will cross, typically from technique right into market, at some point in their jobs. You require to begin someplace, and it's finest to take some time considering your choices. What makes some people pleased is another individual's problem, however we share the general good and bad factors of both accountancy paths

The work-life balance may be worse when you benefit an accounting company and have numerous clients to offer, than if you are concentrating your interest on the success of one organization in industry. Pros Possibility to dive deep into the success of one service as opposed to spreading your efforts across several clients.

The Facts About Redbud Advisors, Llc Revealed

Below are 4 high qualities the Huge 4 firms are looking for in new hires. To be recognized by the thousands of applicants that use for placements at the Large 4, grads need to stand out.

After qualifying, new accountants have the alternative of either operating in practice in an accounting firm or taking a market function out in the company world. Oklahoma Cannabis Laws. Both have their benefits and drawbacks, it simply depends upon the kind of person you are, your passions, and what is vital to you in your job

Several accountants will certainly cross, normally from practice right into industry, at some factor in their careers. Yet you need to begin someplace, and it's finest to take some time considering your alternatives. What makes some people delighted is another person's problem, but we share the basic excellent and poor factors Click Here of both accounting paths.

The Ultimate Guide To Redbud Advisors, Llc

More varied than market in the feeling you are managing customers from various industries, from enjoyment to charity - Cannabis Accounting Firms OKC. You have to be adaptable and meet the needs of different customers. Many companies will certainly give a really clear career course as they intend to preserve the most effective ability, so development possibilities can be exceptional

The work-life equilibrium may be worse when you work for an accounting firm and have numerous customers to offer, than if you are focusing your attention on the success of one business in sector. Pros Opportunity to delve deep into the success of one business instead than spreading your initiatives across many customers.